Global C&I Energy Storage Growth Drivers: Market Insights & Trends Through 2033

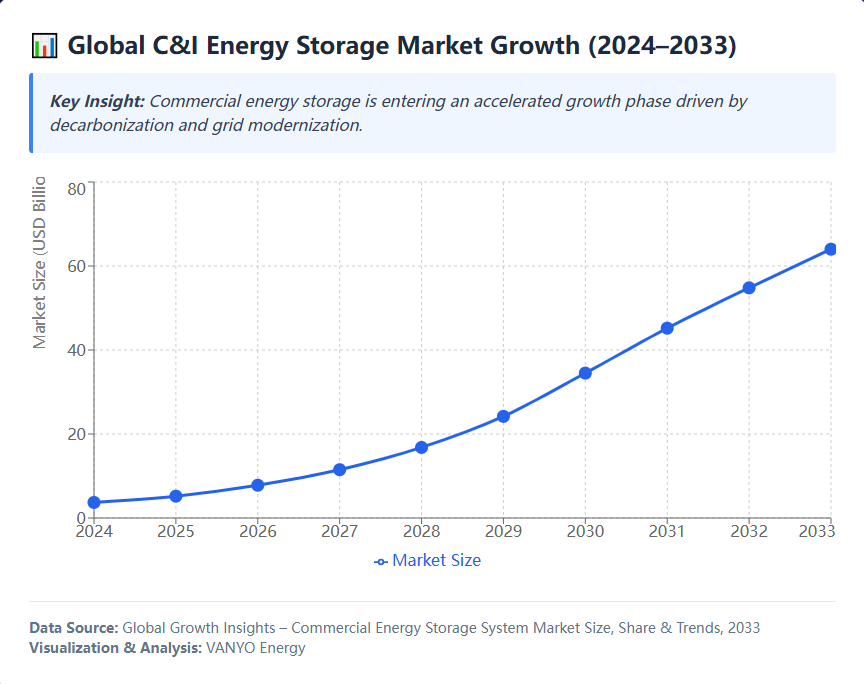

Commercial and industrial (C&I) energy storage systems are rapidly transforming the way enterprises manage cost, reliability, and sustainability in electricity usage. Accelerated by stronger renewable adoption and grid modernization, the global C&I energy storage market is on a steep growth trajectory. According to a recent industry report, the market is expected to expand from about USD 3.69 billion in 2024 to roughly USD 64.02 billion by 2033, representing a compound annual growth rate (CAGR) of ~37.3% over the forecast period; this underscores the strong market demand and emerging investment opportunities.

Key Market Growth Drivers

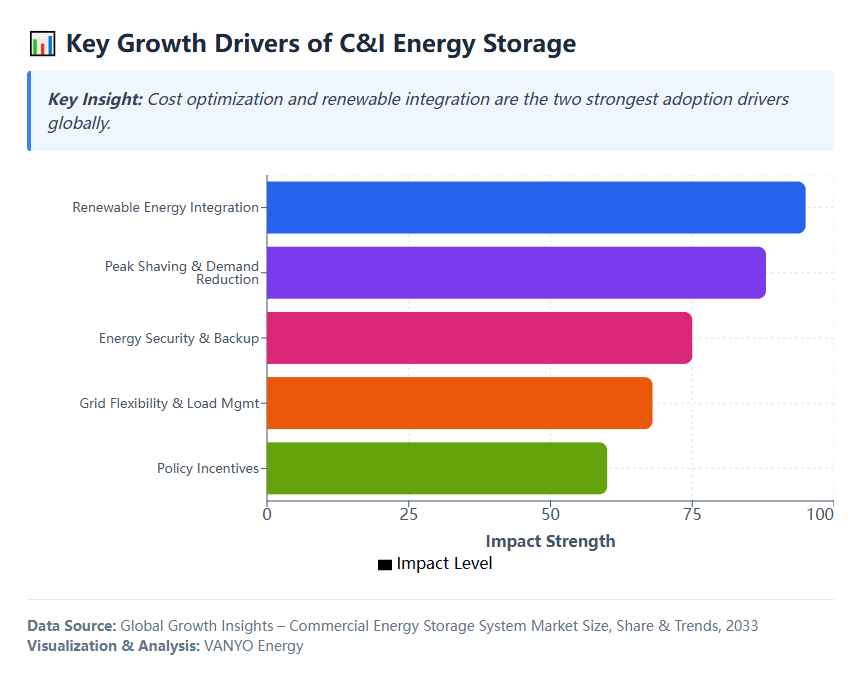

The growth of C&I energy storage is not coincidental—multiple fundamental forces are working together to accelerate adoption worldwide. Below are the core drivers shaping the sector:

1. Integration with Renewable Energy Sources

As commercial entities increasingly deploy on-site solar and wind systems, energy storage becomes essential to balance intermittent generation and ensure energy reliability. Storage systems allow enterprises to shift energy usage from times of excess generation (e.g., midday solar peaks) to high-demand periods, optimizing self-consumption and reducing grid dependence.

In many commercial sites, pairing energy storage with renewables now accounts for more than one-third of new projects, creating hybrid systems that improve both economics and carbon performance.

2. Cost Savings Through Peak Shaving and Demand Charge Management

A primary and measurable advantage for enterprises is the reduction of operational costs. Electricity pricing frameworks, especially in markets employing time-of-use tariffs, result in situations where organizations incur substantially higher expenses for energy utilized during peak demand periods. Commercial and industrial (C&I) energy storage systems facilitate:

- Peak shaving: Reducing demand charges by discharging stored energy during high-price periods

- Load shifting: Moving consumption to lower-cost times

- Arbitrage opportunities: Buying electricity when cheap and discharging when expensive

The financial incentives alone have driven nearly half of commercial adopters to implement storage systems primarily for demand charge optimization.

3. Enhanced Reliability and Energy Security

Business continuity is crucial. In sectors such as manufacturing, logistics, healthcare, and data centers, power outages can cause millions in losses and disrupt operations. Commercial and industrial (C&I) energy storage systems offer backup power, safeguarding essential equipment during grid failures or severe weather conditions.

Almost 40% of commercial facilities identify enhanced resilience as a key motivation for implementing energy storage systems, frequently linked to wider risk management approaches.

4. Technological Innovation and System Intelligence

Technological advancements in battery chemistry, thermal management, and digital energy management platforms are expanding system capabilities and lowering lifecycle costs. Key trends include:

- Modular and scalable ESS configurations

- Integration of AI-driven energy management systems

- Advanced safety and monitoring features

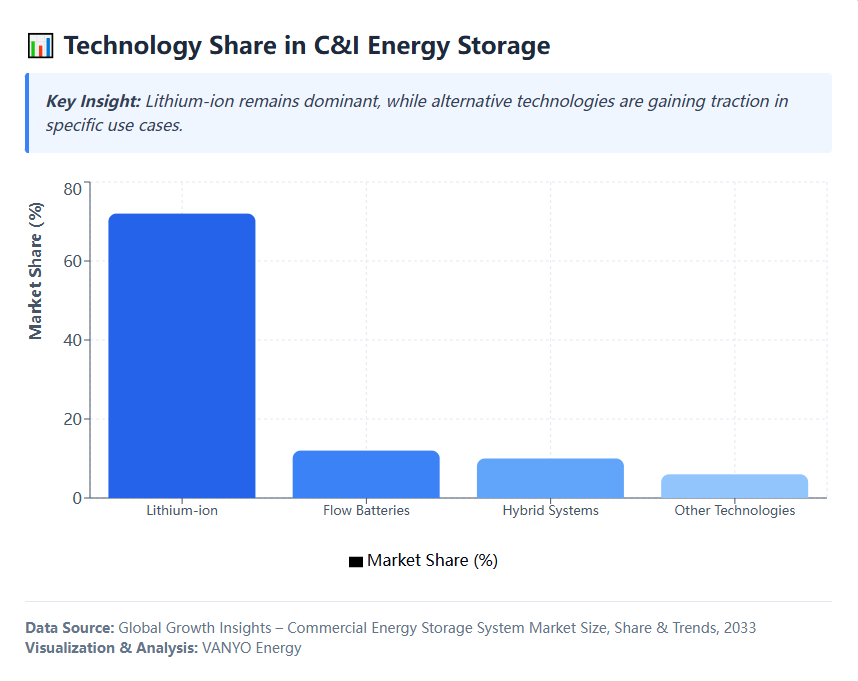

Additionally, lithium-ion remains the dominant technology due to cost effectiveness and performance, supporting a large share of commercial ESS deployments.

5. Supportive Policy Frameworks and Incentives

Government incentives, including tax credits, grants, and utility rebates, substantially enhance the economic viability of commercial and industrial (C&I) energy storage systems.In jurisdictions with rigorous renewable energy requirements and emissions reduction objectives, corporate investment in these technologies is further incentivized. Moreover, regulatory structures that enable engagement in grid services, including frequency regulation and demand response, enhance the potential revenue streams for operators of energy storage systems.

These policy instruments continue to serve as a pivotal catalyst for adoption across Europe, North America, and certain parts of the Asia-Pacific region.

6. Emergence of New Business Models

Innovative commercial models, including Energy-as-a-Service (EaaS) and leasing arrangements, have substantially diminished adoption barriers by minimizing initial capital investment requirements. These financing mechanisms enable organizations to implement energy storage systems (ESS) without incurring significant upfront expenditures, thereby facilitating accelerated market penetration within small and medium-sized enterprise sectors.

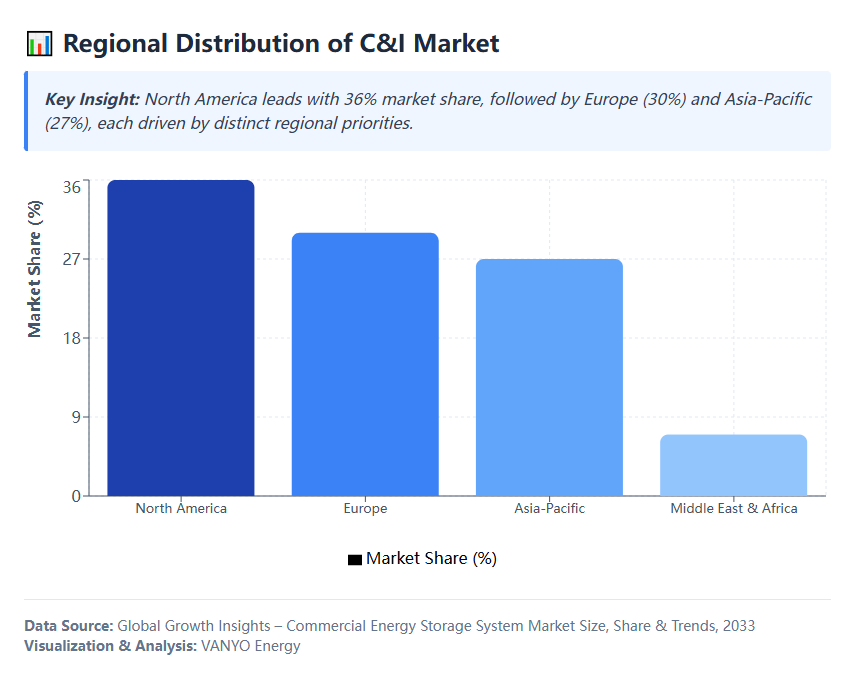

Regional Adoption Dynamics

North America leads in C&I storage deployment, driven by strong policy support and higher commercial electricity rates. Europe follows with a focus on sustainability goals, while Asia-Pacific growth is powered by industrial electrification and grid modernization investments.

The commercial energy storage sector is experiencing strong growth, driven by economic factors, technological advancements, and supportive policies. Companies implementing energy storage solutions are reducing expenses while enhancing energy reliability and sustainability. With ongoing technological improvements and easier access to financing, energy storage for commercial and industrial use is poised to become a key component of contemporary business energy plans.

Source: Global Growth Insights – Commercial Energy Storage System Market Size, Share & Trends, 2033

Chart: Compiled and visualized by VANYO Energy based on publicly available market data

Note: All charts and visualizations are independently compiled by VANYO Energy based on publicly available market research and industry reports, including data from Global Growth Insights. The visual representations are intended for analytical and informational purposes only.

Home

Home

How to Dispose of Lithium-Ion Batteries Safely and Responsibly

How to Dispose of Lithium-Ion Batteries Safely and Responsibly

Address: Wanyang Gold and Silver Building 6, Circular Economy Park, Sili Town, Jiyuan City, Henan Province, China

Address: Wanyang Gold and Silver Building 6, Circular Economy Park, Sili Town, Jiyuan City, Henan Province, China