Global Energy Storage 2025: 5 Massive Shifts Reshaping the BESS Landscape

2025 was the year energy storage graduated from a "supporting role" to a "leading actor" in the global energy transition. Despite shifting political climates and trade complexities, the sector smashed previous installation records. Drawing insights from recent industry analysis by ESS News, we break down the five defining trends of 2025.

The "Price Floor" Has Been Shattered

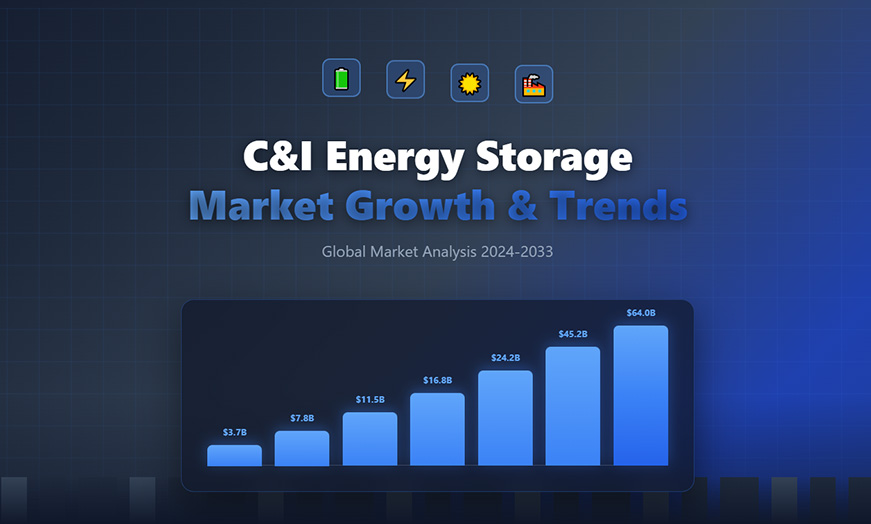

While the industry anticipated falling costs, 2025 exceeded all expectations. Driven by LFP (Lithium Iron Phosphate) dominance and manufacturing overcapacity in China, battery pack prices for stationary storage plummeted to a historic low of $70/kWh—a 45% year-on-year drop.

The Impact: For the first time, stationary storage is the cheapest category across all lithium-ion applications, outperforming even the EV sector in cost-efficiency.

Regional Divide: A significant price gap remains; while China leads with the lowest costs, the US and Europe still face a 30-48% premium due to local supply chain immaturity.

The Era of High-Density "Megablocks"

The technical race in 2025 was all about energy density. The industry quickly pivoted from 3MWh to 5MWh containers, and then to even more massive configurations.

Key Innovation: Industry leaders like Tesla, BYD, and Gotion have pushed the boundaries. Tesla’s 20 MWh Megablock and BYD’s 14.5 MWh systems are redefining the footprint of utility-scale projects.

Logistics Shift: To handle the extreme weight of these units, we saw a rise in modular, open-frame architectures that simplify installation while maximizing land-use efficiency.

China: Moving from "Mandates" to "Market Maturity"

China, the world’s largest storage market, underwent a strategic pivot. The government officially scrapped the mandatory energy storage requirement for renewable projects in mid-2025.

Why it matters: Storage must now prove its profitability through energy arbitrage and ancillary services rather than policy compliance. This is forcing a consolidation of the supply chain, weeding out "irrational competition" in favor of high-quality, long-term stability.

The US Market: A Policy Rollercoaster

In the United States, 2025 was characterized by "regulatory whiplash." While the IRA (Inflation Reduction Act) incentives faced rollbacks under the new administration, the base 30% Investment Tax Credit (ITC) remained a vital lifeline.

The Challenge: Rising interconnection costs and softening peak-hour power prices in Texas (ERCOT) and California (CAISO) have squeezed margins, leading to the cancellation of nearly 79 GW of planned capacity as developers wait for better economic clarity.

Europe’s "Storage Awakening"

Beyond the UK, the rest of Europe finally caught the storage fever.

Germany has emerged as a powerhouse with a grid-connection queue exceeding 500 GW.

Italy and Poland are leading the way in Southern and Eastern Europe through massive subsidy programs and capacity auctions.

Energy Security: Post-desynchronization from the Russian grid, the Baltic region has become a hotspot for BESS deployment to ensure frequency stability.

The 2025 landscape shows a sector that is no longer dependent on hype, but on hard economics and engineering breakthroughs. As we look toward 2026, the focus will shift from "how much can we build" to "how efficiently can we trade."

Source Credit: This article was inspired by and references data from the "Energy storage in 2025: Year in review" report originally published by ESS News.

Home

Home

2025 Residential Energy Storage Trends: From Technology Pioneers to Home Autonomy

2025 Residential Energy Storage Trends: From Technology Pioneers to Home Autonomy

Dec 15,2025

Dec 15,2025

Address: Wanyang Gold and Silver Building 6, Circular Economy Park, Sili Town, Jiyuan City, Henan Province, China

Address: Wanyang Gold and Silver Building 6, Circular Economy Park, Sili Town, Jiyuan City, Henan Province, China